Search for your Service Tax/ GST Jurisdiction for GST Registration

Hello,

We are writing this to track any person GSTIN number for verifying details and quoting correct GST number in invoices.

Track GST Number of dealers before raising or taking invoice

For India GST, the following is the format for the India GST number that contains the Indian State Code, the Indian PAN number and the other values.

| State Code | PAN | Entity Code | Blank | Check Digit | ||||||||||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 |

The list of India State Codes for GST reporting

| State / UT Code | State /Union Territory Name | State / UT Code | State /Union Territory Name |

| 01 | Jammu & Kashmir | 20 | Jharkhand |

| 02 | Himachal Pradesh | 21 | Odisha (Formerly Orissa |

| 03 | Punjab | 22 | Chhattisgarh |

| 04 | Chandigarh | 23 | Madhya Pradesh |

| 05 | Uttaranchal | 24 | Gujarat |

| 06 | Haryana | 25 | Daman & Diu |

| 07 | Delhi | 26 | Dadra & Nagar Haveli |

| 08 | Rajasthan | 27 | Maharashtra |

| 09 | Uttar Pradesh | 28 | Andhra Pradesh |

| 10 | Bihar | 29 | Karnataka |

| 11 | Sikkim | 30 | Goa |

| 12 | Arunachal Pradesh | 31 | Lakshadweep |

| 13 | Nagaland | 32 | Kerala |

| 14 | Manipur | 33 | Tamil Nadu |

| 15 | Mizoram | 34 | Pondicherry |

| 16 | Tripura | 35 | Andaman & Nicobar Islands |

| 17 | Meghalaya | 36 | Telangana |

| 18 | Assam | 37 | Andhra Pradesh |

| 19 | West Bengal |

COMPOSITION DEALER UNDER GST:

Who can opt for composition scheme?

The turnover must be within Rs 75 lakh.

This limit has been reduced to Rs 50 lakh for below states

Arunachal Pradesh ,Assam , Manipur, Meghalaya, Mizoram, Nagaland, Sikkim, Tripura, and Himachal Pradesh.

Who cannot opt for composition scheme?

Rates of tax for composition scheme:

These rates are an aggregate of CGST and SGST rates and will be the final rate of tax payable by composition dealers based on their turnover.

Returns of a composition dealer:

Composition dealer will file GSTR-4 on a quarterly basis and an annual return in FORM GSTR-9A.

Other restrictions:

GST Applicability

(Rs. 10 lakh for special category States)

GST Portal features (gst.gov.in)

For Tax professionals

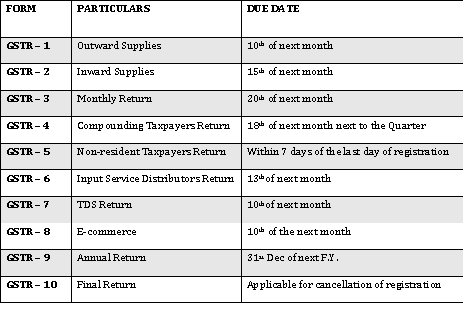

Some important GST returns

| FORM | PARTICULARS | DUE DATE |

| GSTR – 1 | Outward Supplies | 10th of next month |

| GSTR – 2 | Inward Supplies | 15th of next month |

| GSTR – 3 | Monthly Return | 20th of next month |

| GSTR – 4 | Compounding Taxpayers Return | 18th of next month next to the Quarter |

| GSTR – 5 | Non-resident Taxpayers Return | Within 7 days of the last day of registration |

| GSTR – 6 | Input Service Distributors Return | 13thof next month |

| GSTR – 7 | TDS Return | 10thof next month |

| GSTR – 8 | E-commerce | 10th of the next month |

| GSTR – 9 | Annual Return | 31st Dec of next F.Y. |

| GSTR – 10 | Final Return | Applicable for cancellation of registration |

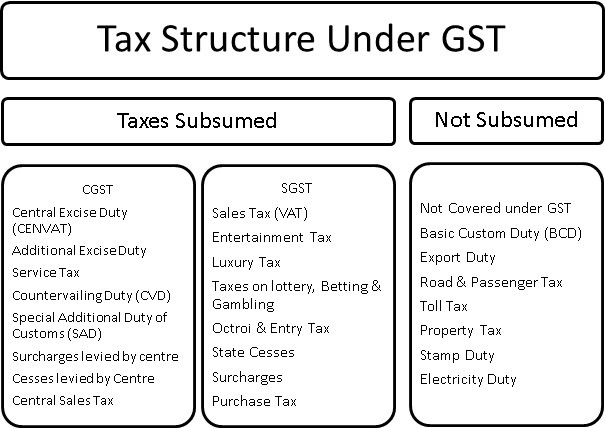

Fundamental Changes from Existing to new Tax Regime

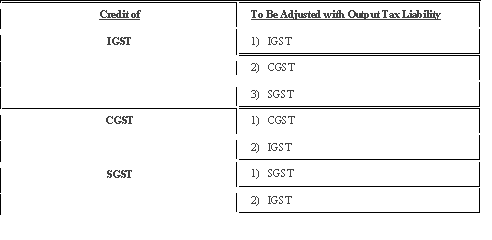

How to adjust the Credit?

Setoff of IGST, CGST & SGST will be as follows in the below mentioned chronological order only.

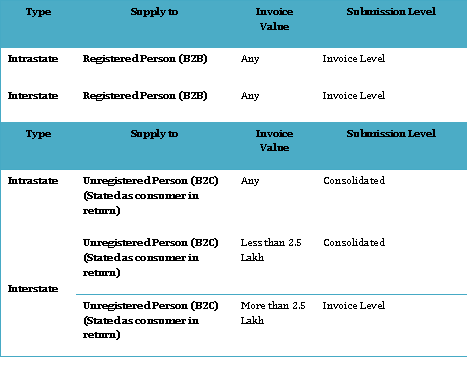

GSTR-1 : Submission Level

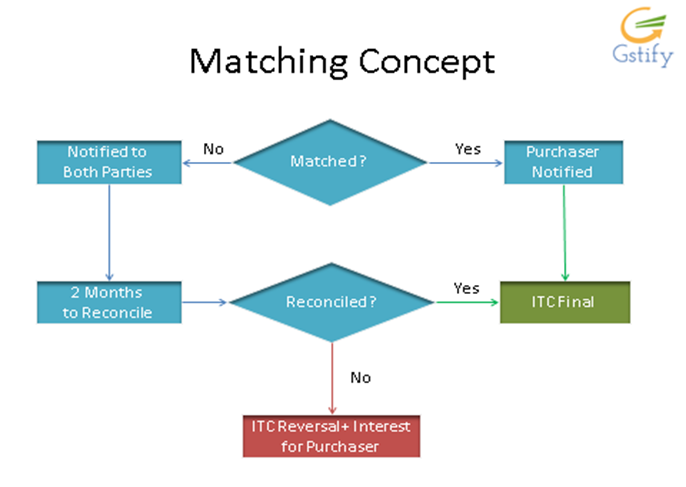

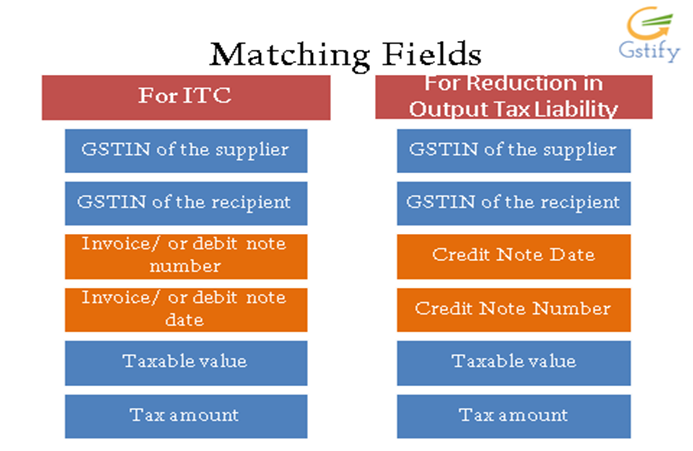

Matching cannot be done for ITC/ Output Tax Liability

If the supplier

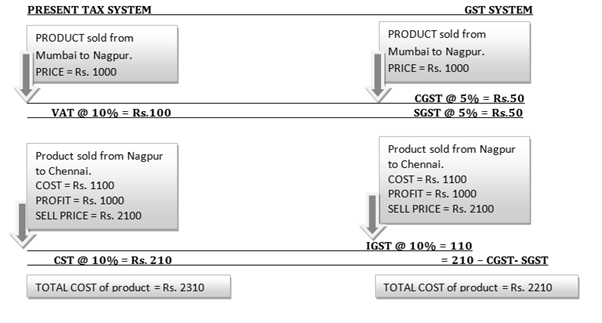

What impact GST will have on pricing of products as compared to current scenario?

Let us take an EXAMPLE to understand this clearly.

In the above example, you can note that the tax paid on sale within state can be claim against tax paid on sale outside state in GST system, which is not in present tax system.

The credit of CGST cannot be taken against SGST and credit of SGST cannot be taken against CGST but both credits can be taken against IGST.

For India GST, the following is the format for the India GST number that contains the Indian State Code, the Indian PAN number and the other values.

| State Code | PAN | Entity Code | Blank |

Check Digit |

||||||||||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 |

The list of India State Codes for GST reporting

| State / UT Code | State /Union Territory Name | State / UT Code | State /Union Territory Name |

| 01 | Jammu & Kashmir | 20 | Jharkhand |

| 02 | Himachal Pradesh | 21 | Odisha (Formerly Orissa |

| 03 | Punjab | 22 | Chhattisgarh |

| 04 | Chandigarh | 23 | Madhya Pradesh |

| 05 | Uttaranchal | 24 | Gujarat |

| 06 | Haryana | 25 | Daman & Diu |

| 07 | Delhi | 26 | Dadra & Nagar Haveli |

| 08 | Rajasthan | 27 | Maharashtra |

| 09 | Uttar Pradesh | 28 | Andhra Pradesh |

| 10 | Bihar | 29 | Karnataka |

| 11 | Sikkim | 30 | Goa |

| 12 | Arunachal Pradesh | 31 | Lakshadweep |

| 13 | Nagaland | 32 | Kerala |

| 14 | Manipur | 33 | Tamil Nadu |

| 15 | Mizoram | 34 | Pondicherry |

| 16 | Tripura | 35 | Andaman & Nicobar Islands |

| 17 | Meghalaya | 36 | Telangana |

| 18 | Assam | 37 | Andhra Pradesh |

| 19 | West Bengal |

Regards

CA Shashank Agrawal

Hello to all !

Today we are sharing GST Complete E-Book which includes Complete GST law, CGST, IGST, UTGST, Compensation Law, Updated Circulars, notifications and decisions of GST Council.

GST E-Book Compiled upto 30th June 2017 by CA Shashank Agrawal

Thanks

Team DDA